In case you wonder, there’s not been much activity around here due to a project over at the Pol. Think Project Lobster, but Eurocratic. Expect an uptick on the blog from now on.

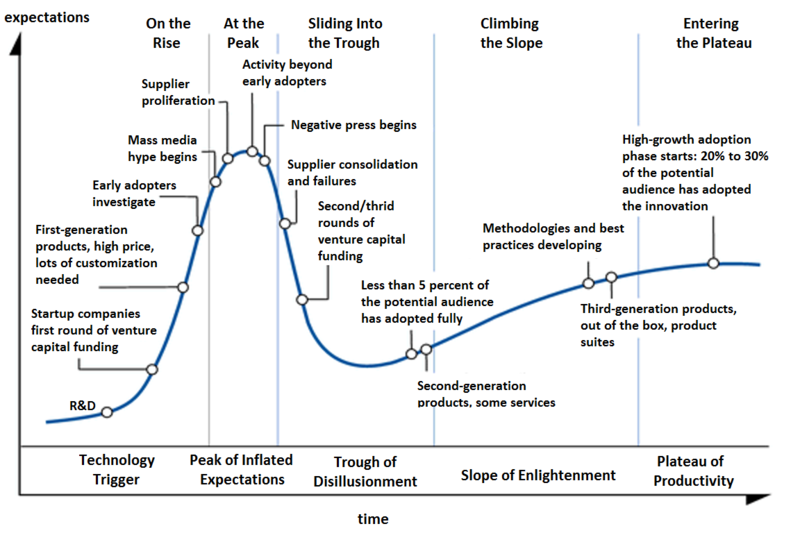

First of all, something that has struck me at work and by following Maciej Ceglowski‘s talks. We all remember the crack from the 2008 financial crisis – when it matters, all correlations go to unity. Let’s apply this to the celebrated Gartner hype cycle. If anyone’s not seen it before, here’s Wikipedia’s CC-BY-SA licensed version of the chart, by user NeedCokeNow.

What interests me is that this is basically OK from wider society’s perspective so long as the hype-cycles are uncorrelated. In 2000, the .com crash wasn’t so bad because most of the wider economy – even the IT sector – didn’t care that much, even though there was substantial correlation between the .coms and the fixed-line telecoms industry. (Mobile was an important source of decorrelation.)

But the more they become correlated, the more additional risk accumulates just because of the correlation. Correlation is itself risky, see 2008. We might call it Bacon Meteor risk, in honour of Maciej’s twitter handle, because I like the image of the bacon meteor slamming into the atmosphere, ushering in an impact winter that kills off all the unicorns.

I see the risk accumulating due to the correlation of three Valley subsegments: Advertising, Big Data, and the Internet of Things. These segments all share the lack of an obvious end-user revenue model, a high degree of regulatory, political, and security risk that isn’t currently accounted for, a highly aggressive VC-led finance model that tends to render their finances even more intransparent than releasing them in untagged PDFs on a 9-month cycle, and most importantly, cross-dependency that brings about tight coupling between the hype cycles.

Ads are the catch-all business case, the justification for all this stuff, the classic case of Maciej’s notion of investor storytime or the world’s most targeted ad (here’s a fine example). Online advertising is itself a business in massive crisis – prices are plummeting, volumes soaring in an effort to keep up, the ad networks have become the world’s premier malware vector, and not surprisingly, everyone’s using ad blockers.

In order to process all the data and deliver the ads, you need the armamentarium of the Big Data sector. Therefore, the ad sector is dependent on the big data guys for technology and the big data guys on the ads for revenue. Collecting all this stuff also means collecting security, regulatory, and political risk.

It also seems that there are diminishing returns to ad targeting data. This ought to be obvious, because advertising aspires to create new customers. That’s the point. Perfect targeting would return only those people who are already certain to buy your product. This is useless, rather like Borges’ map the size of the country. As a result, we’re in a red queen’s race; more and more volume, and more and more categories, of data are needed to win each additional clickthrough.

Hence the Internet of Things and the way every startup in this sector also wants to monetise the data. IoT devices create data, which can be fed into the big data sector, and used to target ads. The ads are meant to validate the investors’ valuations and therefore make the next VC round possible, which incidentally these days usually permits key insiders to cash out, like the IPO used to back in the day.

And you know? I wouldn’t mind seeing the whole smug, creepy, not-as-smart-as-it-makes-out mess with its startlingly poor software dry up and blow away. I am seriously disappointed in the Internet; Google Images can’t find me a pile of dead unicorns. The only problem is that correlation risk. If it didn’t exist I’d be wholeheartedly cheering for a classic rich man’s panic that would hit pretty much exclusively people who can afford to lose the money and richly deserve it. But it does.

The transmission mechanism that worries me is, of course, real estate.

Thought provoking piece as usual. Increasing correlation of risks is really useful concept, thanks. It’s one of the things turning recessions into mini-depressions. When a sector goes down, it’s supposed to be some kind of Schumpeterian opportunity for re-allocation. But in reality, everything is shrinking at the same time, so there’s no-one to take advantage of the falling prices – and bingo, instead of re-allocation, we get zombies. The zombies have to be propped up for similar reasons.

(To be clear I’m actually very skeptical of the standard Schumpeterian tale for other reasons, but this feels like an important description of part of what happened this time around.)

Yes, I have been thinking exactly the same thing, and like you on some level I would like to see it dry up and blow away. Maybe we have to pay money for things like news and email, and witty decontextualised babbling in 140 characters.

Do you think this actually correlates strongly with the real estate market outside SV?

The ‘advertising can fund everything in a libertarian paradise’ meme actually figures in David Friedman’s comedy classic The Machinery Of Freedom.

Permalink

«I am seriously disappointed in the Internet; Google Images can’t find me a pile of dead unicorns.»

Not a pile, but still good:I think:

http://images.google.ca/search?tbm=isch&as_epq=dead+unicorns

Among the first:

http://michaelchsiung.tumblr.com/post/51581321787/hill-of-dead-unicorns-on-flickr-some-old-drawings

Thank you for your dead unicorns!