So, I was out on the #labourdoorstep. And I had an interesting insight. We live in Doorbell Britain, which is divided into two tribes, the Friedlands and the Knockers.

The Friedlands have evidently spent a lot of money on the technology of being alerted to visitors at their front door. Sometimes the bell is slickly modern. Sometimes it is cod-Victorian, but quality cod-Victorian. Sometimes it is disconcertingly silent, leaving you to wonder if it works, but sometimes it makes a noise like a police raid. Sometimes it is gold-plated. Occasionally, it includes a little CCTV camera and a bank of white LEDs to illuminate your face as you wait for a response, wondering whether you should stand politely facing the door or try to display your best profile to the camera. Either way, it’s manufactured by that same German company and it is redolent of an almost intimidating middle-class security that reminded me of, say, the suburbs of Hamburg.

The Knockers are very different. It is not that the bell is absent. Rather, there are usually four or five of the things. The original Edwardian setup is sometimes present, long rusted up and painted over. Several different generations of the technology can be observed. However, none of them work. There may be a name scribbled next to one or more in crabbed handwriting, but it will not be any of the names on the register of electors. If the door opens, it is just as likely that there is an additional voter you didn’t know about than that one is missing. There is sometimes a sticker over one of them with a message like PLEASE DO NOT RING THE BELL – why? – or KNOCK FOR 54C. You end up rapping warily on a window pane, worrying that you might put your fist through the rotting timber of the door itself.

You don’t know, until you talk to them, whether you’re looking at a nest of students or someone on local housing allowance who has a real problem.

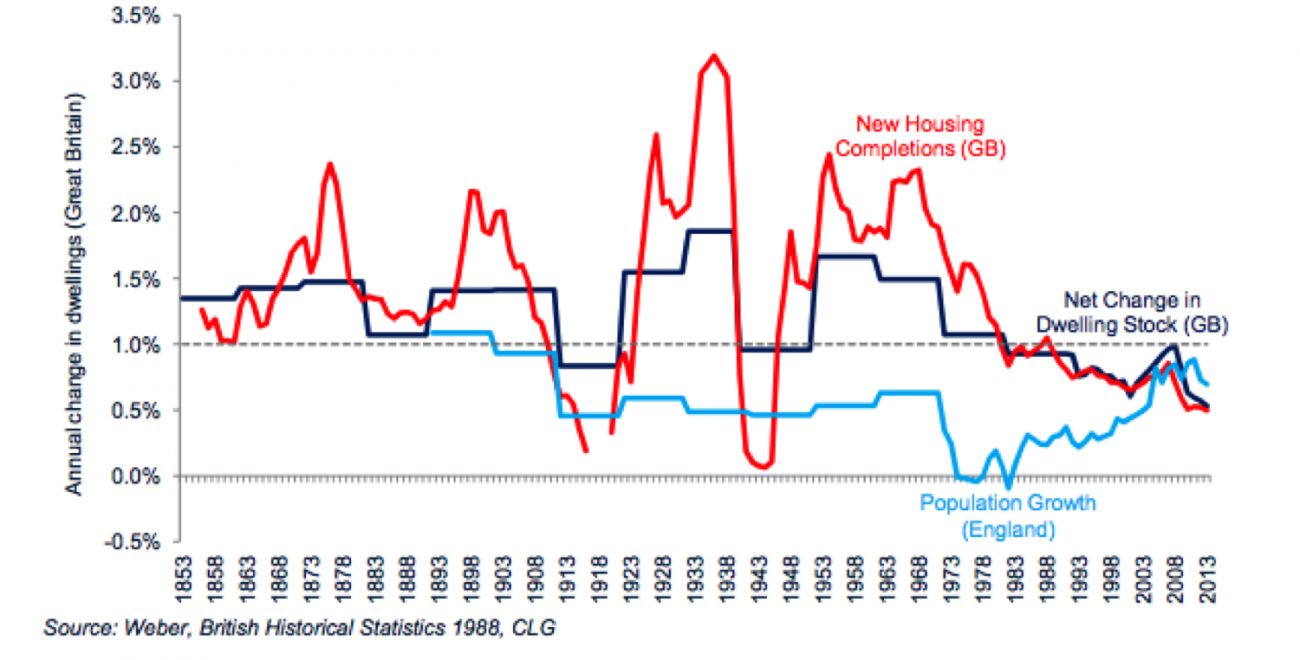

Clearly, what’s doing the work here is the housing crisis. It is fairly well known to specialists that the UK housing economy roughly managed to keep up with the rate of household-formation but it did so mostly by reducing the space available to each household. It should perhaps be better known to the wider public, though, as it helps to explain why it was an invisible crisis for so long and how it survives although so many cranes are visible on the London skyline. This chart shows that the total number of dwellings managed to rise despite the plummeting rate of construction, precisely because we all packed in tighter.

It’s from this post by industry analyst Neal Hudson, who points out that the number of houses in London actually fell as so many of them were subdivided and also that:

While the conversion of terraced properties into flats may be taken by many as an indicator for a lack of supply, it is better as an indicator for stretched affordability as first-time buyers are forced into buying flats and artificially driving up demand for smaller units while actually requiring larger family housing but prevented from buying them by high house prices due to excessive mortgage lending…

That is to say, more and more houses were cut up into flats, more and more euroboxes went up near canals in Northern cities, and more and more existing conversions were revisited and chopped up again in pursuit of more rent. Similarly, the vast expansion of buy-to-let as an investment product generated vast numbers of nonprofessional or perhaps just unprofessional landlords, even before minigarch investors became a thing. As a result, we get Landlordistan, this territory of shinbarking conversions, forever-deferred maintenance, and insecurity, a world on hold, next door to the Bank of Mum & Dad’s head office. But, of course, nobody thinks they’re their kids’ exploitative landlord. As long as it’s somebody else’s, it’s OK.

I said as much to the guy who wanted to complain about the “mansion tax”, and it seemed to cut through as they say – at least, he went from threatening to vote Conservative (a stupid gesture in our Labour/LibDem marginal) to asking to speak to the candidate. So I offer you Doorbell Britain. To place myself in this I would just say that we’ve got four buttons on ours but it does work, although the intercom crackles annoyingly.

It’s not enough, though, tempting as it is, to rail at the BTLers. Hoping for another crash ignores just how…crashy the last one was. As Steve Hilditch says:

My view is that policy has to aim to hold house prices steady for a generation, declining in real terms, avoiding a burst bubble, which creates as many if not more problems as it solves.

That said, 7.5% of GDP is now accounted for by rent we pretend to pay ourselves to live in our own homes and I think everyone can agree that’s too much. The Independent frames a somewhat depressing story of emigration as property rah-rah. This shared ownership project is only available to those who earn less than £66,000 a year, but only affordable to those who earn more than £62,000. The Greens haven’t updated their policy statement in 10 years.

Want an idea? I would borrow the housing wage from the Americans. In a real sense, Doorbell Britain is a story about wages as much as it is about houses, which was part of what I was trying to get at with this post on Bob Crow and Shelter’s estimate that the average Brit took a £29k pay cut in terms of house between 1997 and 2012.

I don’t have much interesting to add to this, but having spent most of my life so far in the suburbs of Hamburg, I’m kind of surprised that you’re not only familiar with them, but have a strong enough impression that other things remind you of them. Are they that distinctive?

absolutely. in 2013 I had the impression of visiting West Germany, not Germany, but also a very odd one of somewhere like Hampstead scaled up to rather bigger than life size.

«Shelter’s estimate that the average Brit took a £29k pay cut in terms of house between 1997 and 2012.»

Sure, but that “average Brit” is meaningless; it is only for people whose asset portfolios are short housing in the South and long labour in the North.

But the people (known as “conservatory building classes”) who bought property in the South during the 1980s and 1990s have enjoyed 150% (gross) yearly profits on their investments for 20-30 years, and they don’t care about pay cuts or actually love them if they are retired, because everybody else’s pay is a cost to them.

But there are many people who bought, or got as inheritance or as divorce settlement, an average property the South priced at £50k in the 80s or £100k in the 1990s (or have enjoyed a 50% gift discount on those prices if they were council properties).

Those people with an investment of £5k to £10k for a deposit have had mostly tax free capital gains of £10-15k a year for decades, plus rent either cashed in or saved, and since they are not thinking of upsizing, that all properties larger than theirs have become unaffordable to them does not concern them, they just want bigger property prices for themselves and smaller pay for everybody else, and New Labour and the Coalition have delivered enthusiastically. Because those people get really angry if the huge stream of property profits going to them stops thwarting their “aspiration” to an affluent lifestyle paid for by other people’s work:

http://www.telegraph.co.uk/comment/columnists/rachelsylvester/3556538/Brown-and-the-conservatory-building-classes.html

«As the middle classes book holidays in Torquay rather than Tuscany, drink tap water instead of San Pellegrino and put the conservatory they had been planning to build on hold, they start to question the amount they have to pay to the Government.»