As a spin-off from #defenduss, Martin O’Neill circulated this report by a US thinktank, which demonstrates that final-salary pensions are actually cheaper to provide than the defined-contribution sort.

The point is simple, but far from trivial – as Max Sawicky is fond of saying about US Social Security, a defined-benefit system is insurance, not mere saving. As such, it needs to finance payouts for the average life expectancy of its members, not the right tail out beyond the 97th percentile. This makes a huge difference to how much cash you need to contribute for each pound of pension entitlement. Further, because it’s a risk pool, the defined-benefit plan can stick with its higher-yielding investments for longer rather than flogging them and buying government bonds.

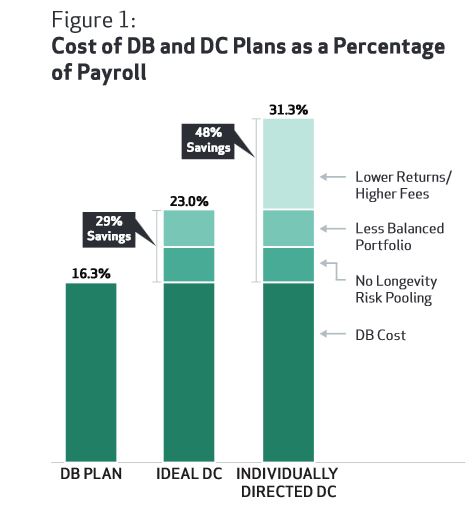

In fact, the only way moving to a defined-contribution system ever saves money is if it’s also a massive cut in benefits. Further, if it’s better in theory, it’s much better in practice, because multi-billion pension funds will always get a vastly better deal in the financial markets than individual savers, and it reduces the opportunities to fuck it up. Here’s the killer chart.

The maddening thing about this document is that I see absolutely no reason why it couldn’t have been issued in 1986, 1996, or 2006. Actuarial science is not new. Neither is insurance. These are technologies that are hundreds of years old now. But I can’t remember anyone making these points out in the public square in any of the endless rounds of Very Serious Debate about pensions, government and corporate efforts to wriggle out of their final-salary plans, and financial sector efforts to convince everyone that they can be trusted this time if we just buy a boatload more of their products. Even the opponents usually opted for either denial that anything was wrong, yelling harder, or else just whining that it wasn’t fair and why not do it to somebody else.

Nobody ever seemed to challenge the notion that defined-contribution was cheaper, which turns out to be not even close to true, for reasons that are inherent in its basic structure. Even I thought there must be some truth to it. It’s not that it would work with better investment returns, more contributions, lower admin costs, or some sort of tweak. It’s that insurance is a far better way of protecting yourself against risk than just putting cash in a shoebox, which is why it exists! And this is a big, fundamental difference. It takes a lot of Harberger triangles to fill an Okun gap, and it takes a hell of a lot of marginal improvement to make up the kind of gap they find here. It’s like when the medics realised it was the sugar that was killing people all along.

There’s nothing else to say.

The damage is done, of course, but this is one reason why #defenduss is a fight worth having, not just some bunch of entitled profs whining. And looky here! Even UUK seems to be weakening.

Wow. That’s something I’d never been into the details of either.

Just shows how skewed the debates tend to get.

It’s no coincidence, of course, that the state pension was (at least nominally) paid for by something called National Insurance. There’s a whole host of concepts here that could do with re-analysis. Pensions are just one form of saving, and all savings could be viewed as insurance of one form or another (“saving for a rainy day”). To take an extreme case, if the government would assure a living wage for everybody, then pensions (or any savings) wouldn’t be necessary.

It’s also worth observing that pensions (and savings) are a relatively modern concept. Yet it seems that today there’s an obsession with asset accumulation and inheritance. Is this the New Insecurity? By design, because policies that prioritise the holders of current assets inevitably prioritise the maintenance of current social divisions. As even the normally-rather-poor Gaby Hinsliff notes (http://www.theguardian.com/commentisfree/2014/dec/04/obsession-inheritance-tax-lost-confidence-in-future) it doesn’t show much confidence in the future.

Yes, I was impressed with Hinsliff connecting the dots there.

And depressed by how many BTL couldn’t (or wouldn’t) get the point.

insurance … needs to finance payouts for the average life expectancy of its members, not the right tail out beyond the 97th percentile.

Thanks for that … never thought of it before, facepalmingly obvious once you see it written down. Needs to be repeated ad nauseam (their nauseam, not ours).