So I said you could hide a million-strong dole queue with enough bogus hairdressing and then it totally like happened.

Shift in jobs market in 6 months incredible: on experimental ONS monthly figs 8% Aug (stuck for 4 yrs) to 6.6% in Feb pic.twitter.com/SFdhaLq0bn

— Faisal Islam (@faisalislam) April 16, 2014

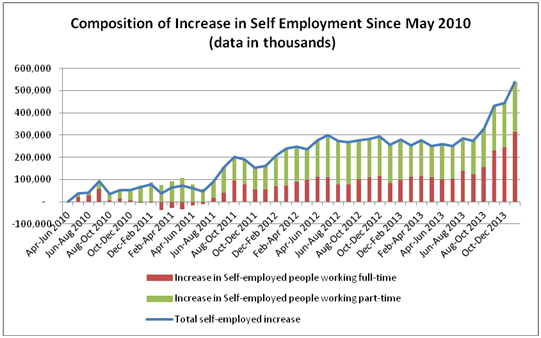

Discussion follows. Fortunately it’s possible to answer this question with data and that’s precisely what Anjum Klair of the TUC policy division’s fine blog did. There’s a lot of detail there, but let’s focus on chart 2.

The green bars represent part-time self-employment, the red ones full-time self-employment. The blue line is the total. Earlier in the second recession, part-time self-employment is driving the total, up to about June 2012. Full-time is flat at this point. The first major uptick is the end of May or beginning of June, 2013. Then there’s a brief dip at the end of August. And then it takes off.

This is crucial, both because it matches Faisal Islam’s chart very closely in point of time, but also, as Anjum Klair points out, it accounts for 82% of the net increase in employment over that period.

So what happened in the spring of 2013? Back on the 3rd of March, 2013, I blogged on a variety of evidence that more or less fictitious self-employment was an emerging survival plan for the unemployed and for badgered Jobcentre Plus staff alike, as well as being a way for chancers like A4e to juice their billings to the government. I called this the bogus hairdresser phenomenon for reasons set out in the post.

I also pointed to this fine post of Voidy’s on the Universal Credit regulations and their tendency to encourage the self-employed to declare more hours.

Basically, declaring self-employment permits you to stop the abuse, permits the Work Programme chancer to bill the government, permits the Jobcentre Plus caseworker to close the file and therefore happy their manager up, and lets you claim Working Tax Credit. If you have kids, you also get additional tax credits in respect of this, which means that you may actually be better off than on JSA. The regulations sort-of get this, giving the DWP the power to bother you to do more hours – therefore pushing you to declare full-time.

So when did the regulations come into force? The 29th of April, 2013. Give them a month to spread through the bureaucracy and for all parties to learn about the new setup, and I think we’ve got a suspect. By October, other people using other methods had also noticed a rapidly growing gap between claimant-count and survey-based measures of unemployment and of underemployment.

Oh, and you were wondering about this? Wonder no more.

Foodbank use is now 20 TIMES higher now than when David Cameron came to power. This graph keeps on growing… pic.twitter.com/HZsC5gUhni

— Labour Left (@LabourLeft) April 16, 2014

Permalink

I wouldn’t disagree that people are declaring themselves as self-employed and claiming working tax credit as an alternative to enduring the ever more onerous JSA regime.

But I can’t see any regulations coming into effect 29th April 2013 which would impact that at all. The universal credit regulations came into force on that date – but only for a tiny subset of the population in a handful of Cheshire postcodes.

I suspect that work programme providers have been pushing self-employment (and the new enterprise allowance) as a cost-effective and politically popular option for getting people off their books.

In April 2011 there was an easement of the hours rules in working tax credit for claimants over 60 – claimants aged 60 or more only need to work 16 hours per week to claim (many would have to have worked 30 hours or more previously). Many semi-retired people may be claiming WTC on this basis (eg people with a small occupational pension, but who are too young to claim the state pension).

Universal credit will be something of a minefield for the self-employed. Cathy Ashley has a useful guide to some of the pitfalls.

Two major components of the rise are caused by older people and migration. See Stronger in Numbers! But that said, I think your analysis rings true for a potentially chunky chunk of the change. A sudden welfare-related stimulus will not have been Universal Credit – as Tim points out its coverage is very limited still – but the benefit cap!

[editor: I fixed the link]

RE changes in April 2013, isn’t that when corporation tax rate was cut to zero for small companies?