This is quite impressive – a very short blog post that explains the Marxist idea of reification in neoclassical economic terms of equilibrium, game theory, and collective-action problems. I think I now know what it means.

A case for Help to Buy. Most of the work in it is either done by the notion that it’s not all that much money, or by the notion that the housing market is still in an abnormal low-liquidity condition and there is frozen supply that could come onto the market if only there were more trades.

If it’s possible for a smallish intervention to cause a lot more trading, though, it’s possible that this might mostly be on the demand side. Dan Davies would argue that it’s the presence of a price-insensitive actor that moves a market. The government in HTB is such an actor, on the buy side. If there were price-insensitive sellers still out there, they wouldn’t be waiting, by definition. Also, if there is frozen supply out there, that’s another way of saying there’s an overhang of sellers. Which way do they expect it to go?

Here’s a Robert Vienneau post even I understand – there are two versions of the firm in perfect competition. One, the classical version, just says that unusually large profits eventually get competed away. The other goes for the whole rational expectations fat bloke slog over midwicket.

In practice, no.1 is far more useful – back in 2009, when the general roaring growth of the smartphone market was selling tons of BlackBerries, it was a sensible and valid point to say “Well, one of the competitors might eventually just win and take over” or “Someone might launch a really professional mobile Linux and give it away, strapping a rocket to whoever can manufacture cheaply at acceptable quality”. Saying instead that “Everything is in the current price of $RIMM” was completely useless and indeed disastrously misleading.

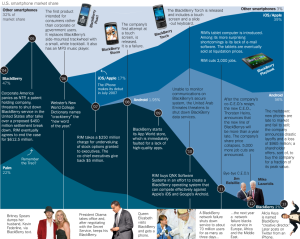

Junk Charts likes this chart and so do I:

It points up two things for me – the underrated, huge impact of Android that was so unprofitable for its authors at Google, and the point that Apple didn’t just barge into the business in 2007, they kept hitting us again. The chart shows nicely that it was the 3GS that really hurt. Also, “other smartphones” peaking in 2006 – that’s us, that is.

League tables make you thick, even two years later. It does worry me in the light of the Ryanair fuel league.